Buyers Expect the House Hunt to Get Easier

Home buyers are up against limited inventories of homes for sale and struggling to triumph in a competitive market. But they’re hopeful for a turnaround over the next few months.

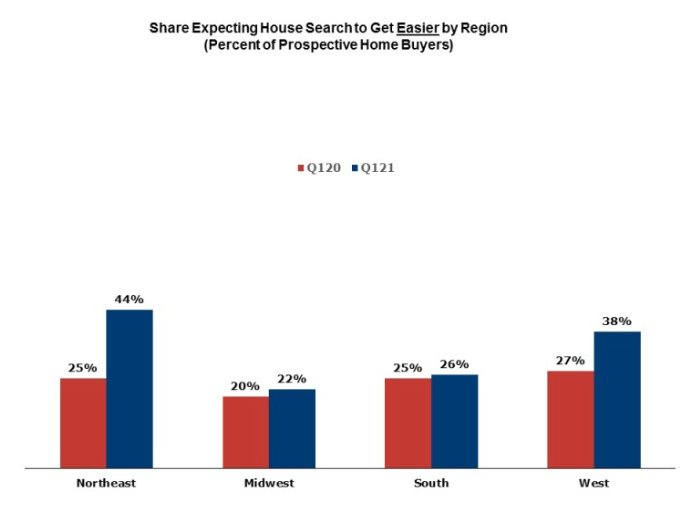

Thirty-three percent of prospective buyers recently surveyed are hopeful that it will be easier to find a home over the coming months—an improvement from 25% who said so a year ago, according to the latest Housing Trends Report, produced by the National Association of Home Builders. Still, the majority–61%—of buyers expect home searches to become more difficult or stay the same in the future.

But why are some buyers more hopeful? More new and existing homes were sold during the first quarter of 2021 compared to a year earlier.

Millennial buyers may be the most upbeat about more prospects opening up in the coming months: 26% in the first quarter of 2020 believed more inventory was coming, compared to 42% in the first quarter of 2021. Other age segments weren’t as hopeful that the market would usher in more housing inventory.

Buyers in the Northeast also were the most optimistic compared to other regions of the country.

Some economists are more optimistic about more housing inventory coming to the market soon, too. New-home construction is ramping up and more homes likely will help relieve some of the pressure in the near future. Read more: Markets Seeing High Homebuilding Rates

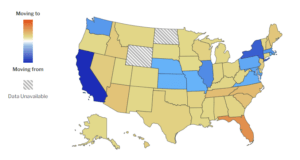

However, demand remains high and that has fueled bidding wars across the country as buyers frantically search for a home to buy. Home shoppers are finding limited choices. Home buyers this spring have 52% fewer homes to choose from than last year, according to realtor.com®’s April Monthly Housing Trends Report.

Source: “More Buyers Expect House Search Will Get Easier in Months Ahead,” National Association of Home Builders’ Eye on Housing blog (April 30, 2021)