BLOG

U.S. Migration Trends: Where are people moving to and from?

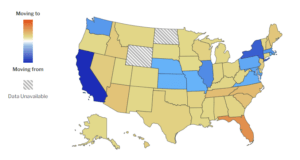

Nationwide, 24% of homebuyers searched to move to a different metro area between Oct ’23 – Dec ’23. The top 5 states homebuyers searched to move to were Florida, North Carolina, Tennessee, South Carolina, and Arizona while California, New York, Illinois, Massachusetts, and Washington were the top 5 states homebuyers searched to move from. Of

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think: Data from NAR shows the median

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving. A recent survey from realtor.com asked why homeowners are thinking about selling their houses this year. Here are the top two reasons (see graphic below): Let’s break those reasons down and explore how they might resonate with

What’s Ahead for Home Prices in 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area of the country.

Why It Makes Sense To Move Before Spring

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that time of year. If you’re ready to

3 Trends That Are Good News for Today’s Homebuyers

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home. As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you

Two Questions Every Homebuyer Should Ask Themselves Right Now

Rising interest rates have begun to slow an overheated housing market as monthly mortgage payments have risen dramatically since the beginning of the year. This is leaving some people who want to purchase a home priced out of the market and others wondering if now is the time to buy one. But this rise in borrowing cost shows no

Why It’s Still a Sellers’ Market

As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal. Even though the supply of homes

Housing Experts Say This Isn’t a Bubble

With so much talk about an economic slowdown, some people are asking if the housing market is heading for a crash like the one in 2008. To really understand what’s happening with real estate today, it’s important to lean on the experts for reliable information. Here’s why economists and industry experts say the housing market is not a bubble ready to pop.

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor keep you updated

Where Are Mortgage Rates Headed?

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.”

What You Need To Budget for When Buying a Home

When it comes to buying a home, it can feel a bit intimidating to know how much you need to save and where to find that information. But you should know, you’re not expected to have all the answers yourself. There are many trusted professionals who can help you understand your finances and what you’ll need

Don’t Get Caught Off Guard by Closing Costs

As a homebuyer, it’s important to plan and budget for the expenses you’ll encounter when you purchase a home. While most people understand the need to save for a down payment, a recent survey found 41% of homebuyers were surprised by their closing costs. Here’s some information to help you get started so you’re not caught off guard

How Global Uncertainty Is Impacting Mortgage Rates

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has

Down Payment Assistance Programs Can Help You Achieve Homeownership

For many homebuyers, the thought of saving for a down payment can feel daunting, especially in today’s market. That’s why, when asked what they find most difficult in the homebuying process, some buyers say it’s one of the hardest steps on the path to homeownership. Data from the National Association of Realtors (NAR) shows: “For first-time home

Want Top Dollar for Your House? Now’s the Time To List It.

When you’re selling any item, you usually want to sell it for the greatest profit possible. That happens when there’s a strong demand and a limited supply for that item. In the real estate market, that time is right now. If you’re thinking of selling your house this year, here are two reasons why now’s

Don’t Let Student Loans Delay Your Homeownership Dreams

If you’re looking to buy a home, you may be wondering how your student loan debt could impact those plans. Do you have to wait until you’ve paid off your student loans before you can buy your first home? Or could you qualify for a home loan with that debt? To give you the answers you’re

Long-Term US Mortgage Rates Hold This Week SILVER SPRING, Md. (AP) — Average long-term U.S. mortgage rates were essentially flat this week after jumping nearly a half percent the past two weeks as lenders anticipated the Federal Reserve’s announcement of pending rate increases. The average rate on the 30-year loan ticked down to 3.55% from

WHEN SELLING YOUR HOUSE, MAKE IT SHINE!

If you’re planning a move in 2022, now’s the perfect time to start getting your house in order. Before investing in repairs and upgrades, consult me to determine your home’s value. Use this information to set a budget, then consider these tips to get your house ready to show: FIRST IMPRESSIONS ARE EVERTHING – Spruce

WHY A WAVE OF FORECLOSURES IS NOT ON THE WAY

With forbearance plans coming to an end, many are concerned the housing market will experience a wave of foreclosures similar to what happened after the housing bubble 15 years ago. Here are a few reasons why that won’t happen. There are fewer homeowners in trouble this time After the last housing crash, about 9.3 million households lost

5 Tips for making your best offer

In today’s sellers’ market, standing out as a buyer is critical. Multi-offer scenarios and bidding wars are the norm due to the low supply of houses for sale and high buyer demand. If you’re buying this fall, you’ll want every advantage, especially when you’ve found the home of your dreams. Below are five things to keep in mind

Understanding the current housing shortage

As the 2021 real estate boom continues with bidding wars and record-selling prices, it’s common to wonder how we got to this point. The pandemic and lockdown forced us to accept personal changes that we weren’t expecting. Though hardships were plenty many people came to realize that not all of the changes were negative. Working

A Look at Home Price Appreciation and What It Means for Sellers

When you hear the phrase home price appreciation, what does it mean to you? Through context clues alone, chances are you know it has to do with rising home prices. And as a seller, you know rising home prices are good news for your potential sale. But let’s look past the dollar signs and dive deeper

Most homeowners have exited mortgage forbearance programs—but those who are left are the most vulnerable

As of March 2021, about two-thirds of homeowners who signed up for some type of mortgage forbearance during the Covid-19 pandemic have exited the programs, according to new research from the New York Federal Reserve. Only 35% of borrowers, or about 2.2 million homeowners, who signed up for forbearance remain in these programs, the New York Fed found.

maximizing sunlight in your house

Natural light adds warmth and beauty to a home, as well as providing a free mood booster. Here are four ways to maximize the amount of sunlight in your space. Choose lighter paint colors. Walls painted in creamy whites or light grays with a satin finish will brighten up a room and reflect more light.

Buyers Expect the House Hunt to Get Easier Home buyers are up against limited inventories of homes for sale and struggling to triumph in a competitive market. But they’re hopeful for a turnaround over the next few months. Thirty-three percent of prospective buyers recently surveyed are hopeful that it will be easier to find a

pending home sales grow in march

WASHINGTON (April 29, 2021) – Pending home sales increased in March, snapping two consecutive months of declines, according to the National Association of Realtors®. All but one of the four major U.S. regions experienced month-over-month gains in March, while each area recorded year-over-year growth. The Pending Home Sales Index (PHSI),* www.nar.realtor/pending-home-sales, a forward-looking indicator of home

savor the season with a spring bucket list

Last year, many people were stuck at home for much of the spring season. In order to safely enjoy the changing season now, consider creating a spring bucket list of activities to do on your own or with family members. Here are some ideas to get you started. STOP AND SMELLL THE ROSES. Spring is

How to avoid home buyer turnoffs

Optimize each and every scheduled showing of your home by avoiding these common buyer turnoffs. Foul Odors. Eliminate any odors related to pets, smoking, mildew, and food. Let in some fresh air through the windows, place an open container of baking soda in smelly rooms and thoroughly clean carpets, furniture and curtains. An Untidy Exterior.

Tax Deductions on Home Equity Loans and HELOCs: What You Can (and Can’t) Write Off

Do you have a home equity loan or home equity line of credit (HELOC)? Homeowners often tap their home equity for some quick cash, using their property as collateral. But before doing so, you need to understand how this debt will be treated come tax season. With the 2018 Tax Cuts and Jobs Act, the rules of home equity

Realtors Are Sharing Their Secrets With Us And Honestly, I’ll Never Look At Zillow The Same Way

Recently, we asked the real estate agents of the BuzzFeed Community to tell us their surprising secrets and stories from working in their field. Here’s what they told us! 1. Places where things like murders have occurred are known as “stigmatized properties” and each state has its own rules on disclosure. “We are legally required to disclose any defects that

keys to a budget-friendly renovation

Home renovation projects are notorious for going over budget. If you’re considering remodeling a portion of your home, use these tips to create a renovation plan that will make you and your bank account happy. Set your priorities. Whether you’re unhappy with the dated tile in your bathroom or you’re looking to add value to

understanding the differences between mortgage providers

If you’re competing against other buyers on a specific property, you’ll also want a lender who can help you make an excellent impression on sellers. Given a choice between two comparable offers, most sellers will pick the buyer who looks better on paper in terms of financing. How do I find a lender? There are

Winter will bring a flurry of activity to the housing market

In the second half of 2020, the housing market surged with activity. Today, real estate experts are looking ahead to the winter season and the forecast is anything but chilly. As Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), notes: “It will be one of the best winter sales years ever.” The typical winter slowdown in the housing market

10 hobbies to try in 2021

After a tumultuous 2020, no one quite knows what to expect in the new year. However, make it a point to spend more time engaging in activities that refresh and energize you, regardless of what lies ahead. Here are 10 hobbies that might pique your interest. Study photo editing– Whether you take pictures with a

Home staging during the holidays

If you’re listing your home during the holidays, it’s important to be mindful of how you decorate and stage your space. Make your house look bright and inviting this season with these suggestions. Elevate curb appeal. Simple strands of white lights can accentuate the architecture of your house, and an elegant wreath of the front

Seasonal home maintenance

Before decorating for the holidays, take time to prepare your home for the winter months. Use this blog to to help you get started! Weatherproof doors and windows. Using clear caulk or weather-stripping to seal any gaps around windows and doors helps prevent warm air from escaping when it’s chilly outside and keeps the

Maximize your kitchen for holiday cooking

The kitchen becomes one of the most-used rooms during the holidays, so take some time to ensure that you have all the space you need for food preparation this year. Consider these simple steps for maximizing your kitchen. Plan ahead and space out food preparation. Whenever possible, try to prepare dishes a day or two

TRICK OR TREAT! HERE’S HOW TO ADAPT YOUR HOME FOR CANDY-SEEKERS THIS HALLOWEEN If you’re participating in the spookiest holiday

Boo! This year has been quite the scare. Like many holidays and celebrations in 2020, Halloween is sure to look different due to the COVID-19 pandemic. For those who plan on doling out candy for their neighborhood ghosts and goblins, consider these ideas for a safer way to accommodate trick-or-treaters. Arrange candy outside The CDC

5 Ways to Declutter Before Listing your home

Toss the Trash We often become “clutter blind” to things that collect in our homes. If you have mail waiting to be sorted, handled, and discarded, magazines and newspapers you intended to read (but probably won’t), and things that need to be recycled, donated or thrown away, do that now. Go through every room in

How to celebrate a waste-free halloween

As Halloween decor, costumes and candy take over retail aisles, you might be tempted to load your cart with convenient, but wasteful, merchandise. However, it’s possible to reduce the amount of trash you send to the landfill on November 1. Here are some suggestions for a more eco-friendly Halloween. Decorations: Use locally grown pumpkins and

More than just a house

As shelter-in-place orders were issued due to COVID 19, houses across the country doubled as offices, classrooms, gyms, places of worship, and much more. This unusual time has revealed just how much we look to our homes to provide a sense of stability, safety and comfort. Americans have long been known for caring deeply about