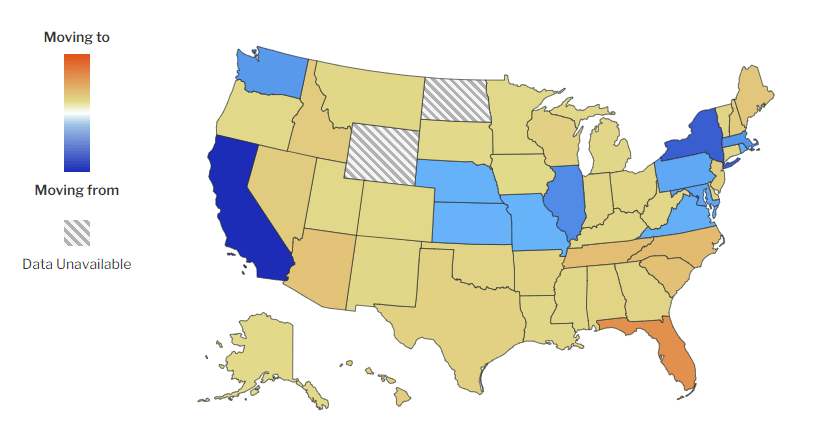

U.S. Migration Trends: Where are people moving to and from?

Nationwide, 24% of homebuyers searched to move to a different metro area between Oct ’23 – Dec ’23. The top 5 states homebuyers searched to move to were Florida, North Carolina, Tennessee, South Carolina, and Arizona while California, New York, Illinois, Massachusetts, and Washington were the top 5 states homebuyers searched to move from. Of […]

U.S. Migration Trends: Where are people moving to and from? Read More »